[ Sat, Jun 28th 2025 ]: CINEMABLEND

[ Sat, Jun 28th 2025 ]: WGNO

[ Sat, Jun 28th 2025 ]: HuffPost

[ Sat, Jun 28th 2025 ]: ThePrint

[ Sat, Jun 28th 2025 ]: BBC

[ Fri, Jun 27th 2025 ]: NME

[ Fri, Jun 27th 2025 ]: Onefootball

[ Fri, Jun 27th 2025 ]: YourTango

[ Fri, Jun 27th 2025 ]: ESPN

[ Fri, Jun 27th 2025 ]: Adweek

[ Fri, Jun 27th 2025 ]: BBC

[ Fri, Jun 27th 2025 ]: Forbes

[ Fri, Jun 27th 2025 ]: Patch

[ Fri, Jun 27th 2025 ]: WMUR

[ Fri, Jun 27th 2025 ]: Yahoo

[ Fri, Jun 27th 2025 ]: NewsBytes

[ Fri, Jun 27th 2025 ]: indulgexpress

[ Fri, Jun 27th 2025 ]: Time

[ Fri, Jun 27th 2025 ]: TechRadar

[ Fri, Jun 27th 2025 ]: Impacts

[ Thu, Jun 26th 2025 ]: People

[ Thu, Jun 26th 2025 ]: WDRB

[ Thu, Jun 26th 2025 ]: Decider

[ Thu, Jun 26th 2025 ]: Parade

[ Thu, Jun 26th 2025 ]: abc7NY

[ Thu, Jun 26th 2025 ]: TechRadar

[ Thu, Jun 26th 2025 ]: Deadline

[ Thu, Jun 26th 2025 ]: MLB

[ Thu, Jun 26th 2025 ]: WFXT

[ Thu, Jun 26th 2025 ]: BBC

[ Thu, Jun 26th 2025 ]: WMUR

[ Thu, Jun 26th 2025 ]: ESPN

[ Thu, Jun 26th 2025 ]: CNN

[ Wed, Jun 25th 2025 ]: deseret

[ Wed, Jun 25th 2025 ]: MassLive

[ Wed, Jun 25th 2025 ]: Uproxx

[ Wed, Jun 25th 2025 ]: BGR

[ Wed, Jun 25th 2025 ]: YourTango

[ Wed, Jun 25th 2025 ]: motorbiscuit

[ Wed, Jun 25th 2025 ]: Forbes

[ Wed, Jun 25th 2025 ]: WMUR

[ Wed, Jun 25th 2025 ]: People

[ Wed, Jun 25th 2025 ]: KTTV

[ Wed, Jun 25th 2025 ]: BBC

[ Wed, Jun 25th 2025 ]: ESPN

[ Tue, Jun 24th 2025 ]: Reuters

[ Tue, Jun 24th 2025 ]: BBC

[ Tue, Jun 24th 2025 ]: CNN

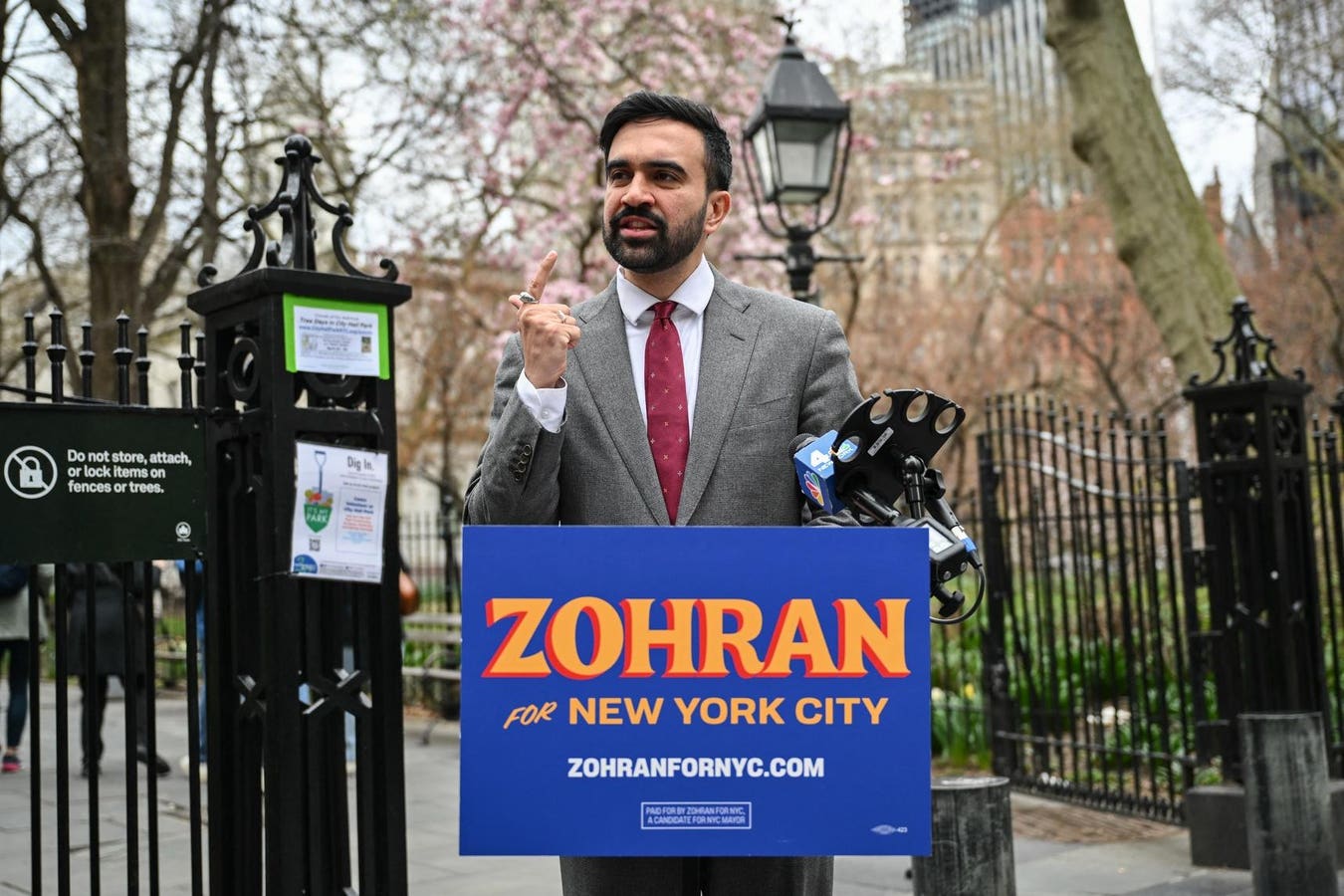

3 Key Issues Surrounding Zohran Mamdani's New York City Tax Increase

Forbes

ForbesThis article discusses who Mamdani is, what about NYC taxes Mamdani proposes to alter, and three key issues with his plans to increase taxes on NYC taxpayers.

Issue 1: The Rationale Behind the Tax Increase

Zohran Mamdani's proposal for a tax increase in New York City is primarily driven by the need to address the city's growing budget deficit. The article explains that New York City has been facing significant financial challenges due to a combination of factors, including the economic fallout from the global health crisis, increased public service demands, and a decline in certain revenue streams. Mamdani argues that a tax increase is necessary to ensure the city can continue to provide essential services such as education, healthcare, and public safety.

The article highlights that Mamdani's proposal specifically targets high-income earners, suggesting a progressive tax structure where those with higher incomes would pay a larger share. This approach is intended to minimize the burden on middle and lower-income residents while generating substantial revenue for the city. The rationale is rooted in the belief that those who have benefited the most from the city's economic environment should contribute more to its upkeep and development.

Furthermore, the article discusses how Mamdani's proposal aligns with broader progressive movements advocating for wealth redistribution and social equity. By focusing on high-income earners, the proposal aims to address income inequality and provide more resources for underserved communities. The article notes that this approach has garnered support from various advocacy groups and progressive politicians who see it as a step towards a more equitable tax system.

Issue 2: Potential Economic Impacts

The second key issue addressed in the article is the potential economic impacts of Mamdani's proposed tax increase. The article presents a balanced view, discussing both the potential benefits and drawbacks of the proposal. On one hand, proponents argue that the tax increase could lead to increased funding for public services, which could, in turn, stimulate economic growth by improving the quality of life and attracting more businesses and residents to the city.

The article cites studies suggesting that investments in education, healthcare, and infrastructure can have long-term positive effects on economic development. By improving these areas, New York City could become more competitive and attractive, potentially offsetting any short-term negative impacts of the tax increase.

On the other hand, the article also acknowledges concerns raised by critics who fear that the tax increase could lead to an exodus of high-income earners and businesses from the city. The article references economic theories that suggest high taxes can deter investment and lead to capital flight, potentially harming the city's economy. Critics argue that if high-income individuals and businesses leave, the city could face a further decline in revenue, exacerbating the budget deficit rather than solving it.

The article also discusses the potential impact on the real estate market, noting that high-income earners are significant contributors to the city's housing market. A tax increase could lead to a decrease in demand for luxury properties, which could have a ripple effect on the broader real estate market. The article emphasizes the need for careful analysis and planning to mitigate any adverse economic impacts while maximizing the benefits of the proposed tax increase.

Issue 3: Political and Public Reception

The third key issue covered in the article is the political and public reception of Mamdani's tax increase proposal. The article notes that the proposal has sparked a heated debate among politicians, advocacy groups, and the general public. Mamdani has received support from progressive politicians and organizations that see the tax increase as a necessary step towards addressing income inequality and funding essential services.

The article highlights that several city council members and state legislators have expressed their support for the proposal, emphasizing the need for a more equitable tax system. Advocacy groups focused on social justice and economic equity have also rallied behind Mamdani, organizing campaigns to raise awareness and garner public support for the tax increase.

However, the article also acknowledges significant opposition to the proposal. Conservative politicians and business leaders have criticized the tax increase, arguing that it would harm the city's economy and drive away high-income earners. The article notes that some business organizations have launched campaigns against the proposal, warning of potential job losses and economic downturns.

Public opinion on the tax increase appears to be divided, with polls showing a mix of support and opposition. The article discusses how public perception is influenced by factors such as income level, political affiliation, and personal experiences with public services. Those who have benefited from public services or believe in the need for greater social equity tend to support the tax increase, while those concerned about economic impacts and personal financial burdens are more likely to oppose it.

The article concludes by emphasizing the importance of continued dialogue and debate surrounding Mamdani's proposal. It suggests that finding a balance between addressing the city's budget deficit and minimizing potential economic impacts will be crucial. The article also calls for more comprehensive studies and analyses to better understand the potential effects of the tax increase and inform future policy decisions.

In summary, the article by Nathan Goldman provides a detailed examination of Zohran Mamdani's proposed tax increase in New York City, focusing on the rationale behind the proposal, potential economic impacts, and political and public reception. The article presents a balanced view, highlighting both the potential benefits and challenges of the tax increase, and underscores the need for careful consideration and planning to ensure the best outcomes for the city and its residents.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/nathangoldman/2025/06/25/3-key-issues-surrounding-zohran-mamdanis-new-york-city-tax-increase/ ]

Similar Humor and Quirks Publications

[ Thu, Jun 19th 2025 ]: Forbes

[ Thu, May 01st 2025 ]: Politico

[ Thu, Jan 30th 2025 ]: Businessworld