RBNZ to Cut Policy Rate to 5.75%, Signaling Inflation Control Effort

Locale: Wellington Region, NEW ZEALAND

Inside economics: How low will they go? RBNZ to cut rate today – but will the banks pass it on?

— A comprehensive recap of the NZ Herald’s in‑depth feature and its wider context

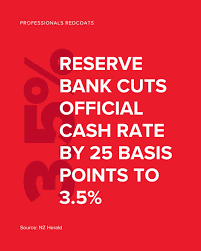

The Reserve Bank of New Zealand (RBNZ) is set to trim its policy rate today, a move that has sent ripples through the New Zealand economy and sparked a fresh debate about the speed and extent of the rate‑cut cycle. The headline‑grabbing story from the New Zealand Herald explains why the RBNZ is moving in this direction, what the likely impact on banks and borrowers will be, and what the future could hold for inflation and growth.

1. Why is the RBNZ cutting rates now?

At the heart of the decision lies the RBNZ’s inflation‑targeting framework. The central bank’s mandate is to keep price stability within a 1 %‑3 % band. Over the last 12 months, headline inflation has eased to about 5.4 % – the lowest level in almost a decade – but still sits above the upper bound of the target range. The RBNZ’s policy statement (link in the article) highlights that the current economic data – including a robust labour market, moderate wage growth, and cooling housing demand – support a gradual easing of monetary policy.

Steve Abraham, the RBNZ governor, emphasized that “the economy is still in a recovery mode, and our policy needs to be flexible enough to support that growth while keeping inflation in check.” The 0.25‑percentage‑point cut, announced in the RBNZ’s policy rate decision link, moves the overnight cash rate to 5.75 %, the lowest it has been since mid‑2022. The decision is also a signal that the central bank expects inflation to remain on a down‑trend and that any future tightening will be delayed.

2. The mechanics of a rate cut: From RBNZ to the bank

The RBNZ’s policy rate is not a direct consumer‑rate; it is the benchmark that commercial banks use when they lend to each other overnight. Banks then decide how that cost translates into the rates they charge customers on loans, mortgages, and savings.

A standard rule of thumb is a “2:1” pass‑through ratio: for every 0.25 % the RBNZ cuts, banks can lower the rates they offer to households by about 0.125 %. The article explains that this ratio is influenced by several factors:

| Factor | How it affects pass‑through |

|---|---|

| Bank balance‑sheet health | Stronger banks can absorb higher costs of funds, easing the need to raise rates on customers. |

| Competitive dynamics | In a crowded mortgage market, banks may lower rates to win market share. |

| Credit risk perception | If the economy is fragile, banks might hold back on rate cuts to protect profitability. |

| Customer demand for loans | Strong demand for mortgages can keep rates high, even after a central‑bank cut. |

The Herald article points to the Bank of New Zealand’s 2024 annual report and the Consumer Credit Association data to illustrate how banks have historically responded to RBNZ moves. In recent cuts, New Zealand banks lowered their variable‑rate mortgage offerings by about 0.10 % on average, while fixed‑rate offers saw smaller reductions due to the longer‑term commitment required.

3. Will banks pass the savings on to borrowers?

While the policy rate has already eased, the article warns that the real‑world impact on borrowers could be modest for a few reasons:

Higher borrowing costs elsewhere – Global central banks, notably the U.S. Federal Reserve, have kept rates high to tackle inflation. New Zealand banks rely heavily on foreign‑currency funding, meaning that a global tightening can offset the benefits of a domestic cut.

Bank profitability concerns – With the economy still recovering, banks may worry about loan defaults. Maintaining a comfortable spread between borrowing and lending rates protects their earnings.

Competition among mortgage lenders – While some banks have reduced rates, others have kept them steady, creating a heterogeneous market where borrowers can shop for the best deal.

The article quotes several industry insiders. “The 0.25‑point cut will translate into a 0.10‑point reduction in variable‑rate mortgages,” says Lydia Ng, a mortgage broker in Auckland. “But many borrowers will see only a few basis points difference.”

The article also highlights that fixed‑rate mortgage offers have remained largely unchanged. Many banks see a fixed‑rate loan as a longer‑term commitment; therefore, they are more cautious about cutting rates until the economic outlook is clearer.

4. Inflation outlook and the future path

One of the key questions the article tackles is: How low will rates go? The RBNZ’s forward guidance (link provided) indicates that they are not yet committed to another cut this year but are monitoring inflation data closely. The bank’s inflation forecast shows headline inflation at 5.0 % by the end of 2025, with the core inflation rate (excluding food and energy) moving toward the 1 %‑3 % target band.

The article brings in research from the University of Auckland’s Institute for Applied Economics (link to the study). Their analysis suggests that if inflation cools to 4.5 % and the labour market stays strong, the RBNZ might consider another 0.25‑point cut in the next meeting. However, should global markets see a sudden spike in commodity prices or a slowdown in U.S. growth, the central bank could pause or even pause the easing cycle.

5. Households and businesses: The practical take‑away

The feature explains the practical implications for different stakeholders:

Homeowners with variable‑rate mortgages – Expect a small reduction in monthly payments. Over a 30‑year mortgage, this could save a few thousand dollars.

Homeowners with fixed‑rate mortgages – Might need to refinance to capture lower rates, but the cost of refinancing could offset the savings unless they hold onto the lower rates for a few years.

Businesses – Lower borrowing costs could boost investment, especially for sectors heavily reliant on credit, such as retail and manufacturing.

Consumers on savings accounts – The overnight cash rate feeds into the rates banks offer on savings. However, the article notes that savings rates are currently below the inflation rate, meaning real returns are negative.

6. Broader policy environment

The Herald’s article also contextualizes the RBNZ decision within a broader global monetary policy landscape. Key points include:

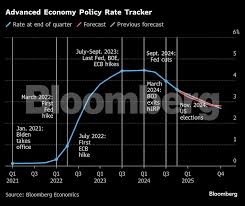

U.S. Federal Reserve’s stance – With the Fed still in a tightening mode, global liquidity is tightening, which could constrain New Zealand banks.

RBNZ’s independent stance – Despite global pressures, New Zealand’s policy decisions are primarily driven by domestic data, a principle emphasized by the RBNZ governor.

Risk of a “policy lag” – The article explains that monetary policy decisions typically take 6–12 months to fully impact inflation. Thus, a current rate cut might only show its effect in the second half of 2025.

7. Key take‑aways

| What you need to know | Why it matters |

|---|---|

| The RBNZ is cutting its policy rate to 5.75 %. | A step toward bringing inflation into target. |

| Banks may lower mortgage rates by ~0.10 %. | Consumers might see modest savings, but the difference is small. |

| Inflation is expected to trend downward but remains above target. | Signals that future cuts may be delayed or limited. |

| Global rate dynamics influence local outcomes. | New Zealand’s monetary policy must account for international conditions. |

| The impact on borrowers will depend on the balance‑sheet health of banks and competitive market dynamics. | The real‑world effect can vary significantly across households. |

8. Looking ahead

The article concludes with a forward‑looking perspective. If inflation cools as forecasted, the RBNZ could consider a second cut in the next meeting. However, any decision will depend on a mix of domestic data (labour market strength, core inflation, housing affordability) and external forces (global commodity prices, U.S. monetary policy). The outcome will shape not only bank rates but also the broader trajectory of the New Zealand economy.

For now, consumers and businesses should remain vigilant. While the headline rate cut offers a glimmer of relief, the real‑world benefits will unfold gradually and will depend on how banks decide to adjust their own lending rates. The story from the New Zealand Herald, along with the additional linked resources, provides a comprehensive snapshot of where the economy stands today and the possible directions it could take tomorrow.

Read the Full The New Zealand Herald Article at:

[ https://www.nzherald.co.nz/business/economy/inside-economics-how-low-will-they-go-rbnz-to-cut-rate-today-but-will-the-banks-pass-it-on/premium/6C4LCQPDTZBM3PARU72YNC2IYA/ ]