Bank Surveys Reveal Curious Quirks Among Family Office Priorities

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

The 2025 Family‑Office Pulse

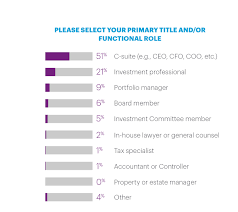

Bloomberg’s newsletter, released on November 4, highlights that two of the largest banks—Goldman Citi and Citi—have published results from their 2025 family‑office surveys. While both institutions drew on a sample of roughly 250 family‑office principals, the findings diverge sharply. Goldman Citi reports a significant uptick in allocation to private‑equity and infrastructure, with 72 % of respondents planning to increase exposure in the next 12 months. In contrast, Citi’s data shows that only 36 % of respondents intend to add more private‑equity capital, citing a shift toward liquidity and short‑term opportunities.

The newsletter explains that the divergence is not a simple matter of different sampling frames; both surveys used the same pool of families identified by Bloomberg’s proprietary database. The key difference lies in how the banks defined “private‑equity exposure.” Goldman Citi counted any capital commitment—including direct deals and secondary purchases—whereas Citi restricted the definition to institutional co‑investment vehicles. When both banks re‑analysed the data using a common definition, the gap narrowed but did not disappear: Goldman still shows a 15‑percentage‑point lead.

Methodological Nuances

The article goes on to dissect the methodological nuances. Goldman Citi’s survey was conducted through a proprietary panel of family‑office partners, while Citi used a mixed‑mode approach that combined online questionnaires with phone interviews. Bloomberg notes that phone interviews tend to elicit more optimistic answers, possibly because respondents feel more compelled to provide socially desirable responses in a live conversation.

Citi also applied a weighting algorithm that gave higher importance to family offices with assets under management (AUM) over $10 billion, whereas Goldman weighted equally across all sizes. This weighting shift skews Citi’s results toward more conservative families, who traditionally favour cash and low‑risk investments.

Conflicting Results, Same Landscape

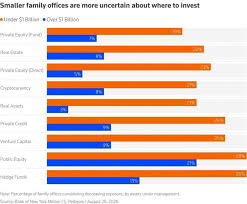

Despite the divergent conclusions, both banks agree on a few fundamental points. Most family offices still see a role for institutional capital in diversifying risk, but they are increasingly cautious about over‑exposure to the same asset classes. Inflationary pressures and the recent volatility in equity markets have made liquidity a higher priority for many households.

The newsletter also links to a Bloomberg report on the “Family‑Office Landscape 2024” that outlines broader trends, such as a growing appetite for direct real‑estate and infrastructure investments, and an accelerated move toward ESG‑aligned portfolios. Both Goldman Citi and Citi echo these trends, albeit with differing degrees of enthusiasm.

Impact on Bank‑Family Office Relationships

For banks, the conflicting results signal a shift in competitive dynamics. Traditional relationship managers have relied on surveys to tailor product pitches and forecast revenue streams. The disparity in data forces them to rethink how they approach family‑office clients. The article quotes a former Goldman Citi relationship manager who explained that the firm is now prioritizing “client‑centric analytics” that go beyond simple survey metrics, integrating real‑time portfolio performance and bespoke risk‑adjusted return models.

Citi, on the other hand, is reportedly exploring a new partnership model that would allow family offices to collaborate directly with its investment team on co‑investment opportunities, bypassing traditional fee structures. Bloomberg links to a press release announcing this initiative, noting that it could potentially disrupt the market for boutique family‑office advisors.

Broader Market Context

The newsletter places these findings in the broader context of a tightening global credit environment. With central banks tightening policy, the cost of borrowing has risen, making leveraged deals in private equity more expensive. Family offices are, according to both banks, increasingly looking to reduce leverage and focus on direct ownership stakes that offer greater control and flexibility.

Additionally, the article references a Bloomberg interview with a leading private‑equity analyst who points out that family offices are shifting their risk tolerance. “The last decade has seen a gradual normalization of risk,” the analyst said. “Now we see a pivot back to more traditional, lower‑risk vehicles, but still with an eye on higher‑yield opportunities that can be managed directly.”

Takeaway

The Bloomberg newsletter underscores that while the family‑office ecosystem is still robust, the way banks interpret survey data matters. Goldman Citi’s more aggressive outlook contrasts with Citi’s cautious stance, revealing how subtle changes in survey design, weighting, and data collection can shape market perception. For family offices, the takeaway is that diversification remains key, but the path to diversification is increasingly nuanced, driven by liquidity concerns, risk appetite, and a growing emphasis on direct ownership and ESG considerations. As banks recalibrate their strategies, the next wave of family‑office investment will likely hinge on who can best translate nuanced data into actionable, customized solutions for each household.

Read the Full Bloomberg L.P. Article at:

[ https://www.bloomberg.com/news/newsletters/2025-11-04/goldman-citi-among-banks-issuing-family-office-surveys-with-conflicting-results ]